Forgetting the Denominator

By Amity Shlaes

This essay is adapted from Amity Shlaes’s regular column “The Forgotten Book,” which she pens for “Capital Matters” as a fellow of National Review Institute.

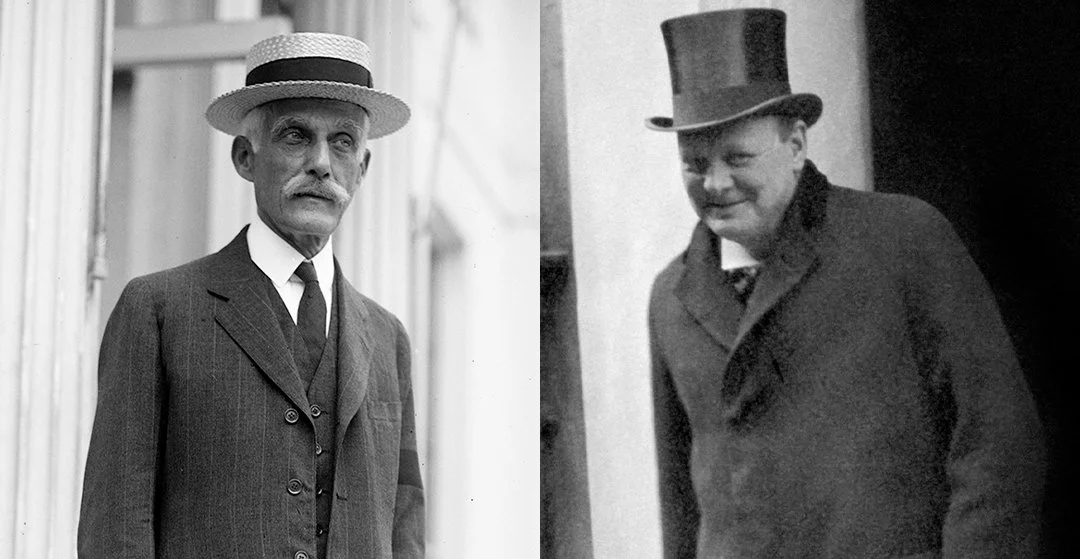

The rest of us have long wondered why one of the greatest conservatives of the twentieth century, Winston Churchill, trashed another great, Calvin Coolidge. Coolidge, true to form, never offered an explanation. Churchill, by contrast, made it clear he thought the American president’s weakness was provinciality. Coolidge had never been to Europe. Sounding like Keir Starmer on a bad day, Churchill once told the British cabinet that the president displayed to the world “the viewpoint of a New England backwoodsman.”

Churchill’s “backwoodsman” jibe was a retort to a rather mild Armistice Day speech in which Coolidge spoke of expanding the U.S. Navy. Coolidge observed that Britain and others had recently demanded an agreement preventing the United States from “that class of combat vessels in which we were superior” (heavy cruisers) while it “refused limitation in the class in which they were superior” (light cruisers). This comment Churchill apparently took as insult to one of Britain’s remaining claims to world supremacy, the Royal Navy.

Churchill likewise disapproved of a man who had a thorough knowledge of Rome and Paris, and the Vermeers and van Dycks to prove it: Coolidge’s treasury secretary, Andrew Mellon. What turned Churchill against the Coolidge administration was something to do with the complex, lengthy negotiations over Britain’s debt from World War I.

And that’s about all of us have known about the mysterious Churchill antipathy.

All the more valuable then is Jill Eicher’s rigorous Mellon vs. Churchill: The Untold Story of Treasury Titans at War. For Eicher does tell the “untold,” concentrating on the more important difference, that over the war debt.

Enter Churchill

Eicher starts her story with the price Britain paid for World War I. In a kind of handshake deal with the Allies, Congress in 1917 opened a credit line of $3 billion for Allies, including Britain. To raise the funds, Congress leaned on the American public and authorized the Treasury to issue Liberty Bonds. The provisional wartime lending stipulated that borrowers like Britain would pay the market rate of interest on its debt.

More loans followed. By the early 1920s, Britain’s debt alone had ballooned to $4 billion, and Britain was paying interest on the floating rate rule set by Congress. France owed Britain multiples more than what Britain owed the U.S. but hardly seemed able to pay. The squeeze on Britain tightened as its own postwar economy stumbled.

The doldrums were hitting America, too, where by 1921, one in ten men was unemployed. Interest rates moved up, increasing the pain for American companies and government. On the hunt for revenue—and for an easy scapegoat—a truculent Congress voted that terms for Britain be set anew: 4.25 percent interest over twenty-five years. Many in Britain rated this a punitive deal, and a plan that would lock in American economic supremacy over Britain. Britons were still bridling over Woodrow Wilson’s comment during the war that “the part that other nations used to play we are playing.” All parties on both sides of the Atlantic “recognized that Britain’s standing and credit in the world was at stake,” Eicher notes.

In 1922, a new prime minister, Andrew Bonar Law, demanded easier terms on the onerous loan from America. Deputized to manage the debt talks, former prime minister Arthur Balfour turned up the heat on the U.S. by pulling Britain’s creditors—France, Italy, Yugoslavia, and others—into what the U.S. wanted to be a simple bilateral negotiation. Balfour argued for “the writing off, in one great transaction, the whole body of inter-allied indebtedness.” Balfour laid out the United Kingdom’s grievance: “The American government have required this country to pay interest accrued since 1919 on the Anglo-American debt,” whereas the UK had not asked for either repayment of either principal or interest from capitals on the Continent thus far. Such remarks always included a dollop of sanctimony: “His Majesty’s government make no complaint of it.”

The reaction in America to the Balfour Note, as the policy statement was quickly known, was predictable. “Uncle Sam is portrayed as a ruthless, relentless, hard-hearted Shylock,” said the Philadelphia Inquirer. “John Bull [England] is depicted as the liberal magnanimous and sympathetic credit whose heart bleeds for his debtors’ sufferings.” Britain doubled down. Could not America understand that Britain deserved lenience, or outright forgiveness? After all, British fatalities in the war had numbered 886,000, or 6 percent of the adult male population. America, more than double in population, had lost only about 66,000.

Enter one Winston Churchill, at that point an out-of-favor member of the UK’s National Liberal Party (“Liberal” in this instance meaning a center party that stood for free trade and national strength). In Parliament, he happened to represent what had been considered a “seat for life,” a constituency in Dundee, Scotland. Unrest after the war so roiled the Scottish port in September 1922 that Churchill brought bodyguards to protect him when he traveled to Dundee to campaign for reelection. The war debt, he told voters, was to blame for the joblessness, 20 percent in their area. There were “monstrous debts of hundreds and even thousands of millions of pounds.” A country that had “mountains of gold in her vaults,” meaning the U.S., should take pity on Britain. The speech won national attention, but Churchill came in fourth in the election—the local communist polled fifth.

The question now was: Where did Churchill fit in? He’d started his career as a Tory, then switched to the Liberals, and now he was out. Churchill retreated to complete a volume of his book The World Crisis.

The Mozart of Debt Restructuring

In the same months that Churchill hit this low, Eicher’s second protagonist, Andrew Mellon, was reaching a new high. As treasury secretary to President Warren Harding, he had already made an impressive start on the administration’s main goal: tax reduction. One tax cut was already behind Mellon, with more to come. It seemed reasonable that the secretary would succeed in the matter of British debt as well. A stupendous career of investment and finance had earned Mellon a reputation as a veritable Mozart—or Alexander Hamilton—of debt restructuring. Congress opposed debt forgiveness. So did Mellon. He approached Britain’s debt pragmatically: Woo and negotiate, according to the other party’s ability to pay.

In January 1923, Mellon commenced his wooing with a dinner for the UK chancellor of the exchequer, Stanley Baldwin, at his top floor apartment at 1785 Massachusetts Avenue in Washington—the same grand structure that is home to the American Enterprise Institute today. There, the guests observed, paintings by some of Britain’s finest, Thomas Gainsborough and John Constable, graced the walls. Dinner was topped off by “bowls of strawberries out of season,” yet another sign of immense American wealth.

Mellon offered his deal: reducing the level of interest to 3.5 percent and extending the repayment period to sixty-one years. Baldwin cabled the offer to London. The next day, Bonar Law cabled back his rejection. Bonar Law wanted 2.5 percent, or no deal at all. As he had said, “We paid in blood, they did not.”

The fortunes of the debt talks went down from there, and Britain plunged into further economic trouble. America lost a president—Harding passed away suddenly in the summer of 1923—but its economy brightened. So did, as it happened, Churchill’s prospects, in part because he moved back to his old party, the Tories: “Anyone can rat, but it takes a certain amount of ingenuity to re-rat,” Churchill supposedly said. At the end of 1924 a new prime minister, Baldwin, made Churchill chancellor of the exchequer. The choice came as a surprise to London, for Churchill was historian and warrior by temperament, lacking even Baldwin’s experience in railroads and finance.

Cattily, the press pointed out that the new chancellor had always had trouble managing even his own money. “Certainly there is something novel in the spectacle of Mr. Churchill in charge of the purse strings,” commented the Sunday Mirror. The chancellor post came with a fine residence at 11 Downing Street, which in fact did much to relieve the Churchills’ financial challenges. The honor was all the more welcome to the Churchills because Churchill’s father, Randolph, had held the chancellorship in the day. As Eicher reports—her book is really good when it comes to detail—Churchill’s mother, Jenny, removed from storage a black silk robe with gold embroidery that Randolph Churchill had worn.

As chancellor, Churchill insisted on returning Britain to the gold standard at the pre-war exchange rate of 4.86 pounds to the dollar. The fact that it was binding itself to the old rule was important, Churchill believed, because it showed Britain to be “steady, trustworthy, [and] honest.” That 4.86 pounds to the dollar was significantly higher than the 4.40 the market was paying. Churchill’s proud move salved British pride but so burdened Britain’s struggling exporters that Churchill later called the decision “the greatest mistake” of his life. He also jumped into the debt battle—with relish. Here, his position was opposite to the one he took on the gold standard: past contracts mattered not.

America showed no sign of yielding: The new U.S. president, Calvin Coolidge, backed both Mellon’s tax drive and his debt approach to the hilt. Ideally, Coolidge said, America would “collect every dollar that is due from foreign countries,” though, he also allowed, his administration had “no intention of bearing down on those countries that find themselves wholly unable to pay.” Thundering in the House of Commons, Churchill reminded his peers—and the world—of Britain’s struggles: “No other victorious nation is making similar or equal sacrifice.”

As America recovered and Britain struggled on, Churchill began to bait Mellon publicly, claiming in 1926 that Mellon’s policy was crafted “to win cheap cheers and a reputation for firmness.”

The slights—from Churchill and others—came so often that Mellon’s staff seethed. And soon enough, Mellon himself slipped. Through oversight or error, the secretary did not prevent his irate staff from sending out a fourteen-paragraph blast rebutting an over-the-transom rant from a Massachusetts retiree charging that America would be “made odious in the estimation of mankind” by its refusal to forgive British debt.

The Treasury rebuttal characterized the bulk of the British debt as “purely commercial”—inaccurate. The press on the Continent went incandescent: In France, so fragile it saw six successive finance ministers in two years, La Liberté charged that “the claims of the United States are holding up the economic recovery of Europe.”

As an editor in London commented, the public feuding of Churchill and Mellon was becoming costly: “Their obvious course as statesmen is either to talk about this miserable business privately, or not to talk about it at all,” a sane recommendation that, a century later, Presidents Trump and Zelensky might also have done well to heed.

Misreading Mellon

Eicher’s mastery lies in the way she captures the deeper dynamics of the lengthy Mellon-Churchill conflict. Then as now, not only a chancellor of the exchequer, but also a U.S. treasury secretary, had to win the support of lawmakers in Parliament or Congress to conclude a deal.

For Congress never relented in its demands for higher rates: “We are not applying the same principles to American farmers as we are to European countries. If the farmer can’t repay a loan, we don’t let him pay according to his ability or income,” said Senator James Reed of Missouri at the end of 1925. “We foreclose the mortgage, take his land and home.” Why not the same for Britain?

Where Eicher fails in an otherwise admirable volume is in her decision to praise Churchill too much, and explain Mellon too little. One finishes the book with an impression of Mellon as etiolated, and slightly corrupt. He was neither. As for the debt: Mellon indeed viewed Britain’s obligations the way a banker views a mortgage contract. “I should rather have solvent customers in the future which permit me to run a profitable business than insist upon terms of debt settlement which will again force my customers into bankruptcy.”

But his dry lexicon does not mean Mellon was inhumane, or illogical. To allow Britain to throw up its hands and default was to ensure that Britain would not be able to borrow in the future, from the United States or anyone else. When Britain did default on its debt to the U.S. in the 1930s—after Mellon’s tenure—it found itself barred from U.S. capital markets by Congress. This, as economist Barry Eichengreen has pointed out, weakened its ability to confront Hitler. When, at the end of the decade, Britain found itself locked in battle with Germany, the help President Franklin Roosevelt could provide was constrained by Congress, which had passed a number of laws, the Neutrality Acts, aimed to prevent the U.S. from sliding into foreign conflict. But the UK default also constrained American support for Britain. Hence support from the U.S. to Britain was at first mostly of the awkward, in-kind variety: equipment, food, and weapons.

Mellon vs. Churchill also neglects a tragic error made by British statesmen, including Churchill. A nation’s debt is a numerator in a fraction. The denominator is the size of the economy incurring the debt. When government policy permits growth, the numerator (the debt) shrinks in importance. Throughout the 1920s, most of Britain’s political establishment backed policies that slowed growth. Unemployment insurance passed into law in the early 1920s was so generous that workers were more selective about when they returned to work. The effects of “the dole” were so obvious the term became a pejorative worldwide.

Not only Britain’s Labour Party but other parties proved too tolerant of union demands, the result being that wages became higher than Britain could afford. As economists Thomas Hatton and Mark Thomas note in their contribution to The Great Depression of the 1930s: Lessons for Today, toward the end of the 1920s some politicians recognized the missteps. The eminent English economist Arthur Pigou—hardly a pure free marketeer—noted in 1927 that as a result of such policies “wage rates have, over a wide area, been set at a level which is too high” and “the very large percentage of unemployment during the whole of the last six years is due in considerable measure to this new factor in our economic life.”

Nowadays, conservatives treat as heresy the slightest criticism of Churchill. Heresy or not, the truth is that out of ignorance, opportunism, or pride, Churchill ignored such realities—and took the easier path of blaming the U.S. for Britain’s struggles.

Mellon by contrast religiously tended his denominator. Together with Harding and Coolidge, he pulled U.S. tax rates down well below Britain’s. The treasury secretary also guarded America’s credit like a flame, reducing the federal debt by one-third. The “backwoodsman” Coolidge for his part made sure markets understood that the White House respected business. U.S. growth under Coolidge averaged 4 percent per annum, more than double Britain’s rate.

To be sure, Britain’s troubled economy would have made it far tougher—Churchill would have said impossible—to go the free-market path. But Britain could have tried, a little. In any case: It was Harding-Coolidge-Mellon policy, and not debt betrayal, that gave America its lock on global primacy.

In any case: Mellon awaits his own revision. So do the American economic achievements of the 1920s. For, as Eicher suggests early in her text, unbearable debt will, or already does, cripple many countries. What the 1920s demonstrated is that debt relief is a necessary, but not sufficient, condition for a nation’s long-term solvency.

Often enough, the better way to overcome debt is to grow yourself out of it.

Amity Shlaes chairs the Coolidge Foundation, is the author of Great Society, and is a fellow of National Review Institute. A version of this article first appeared in National Review’s “Capital Matters.”